The global economy has taken several big strides with the advent of technology and digitization of financial activities. Today, you are not restricted to money transfer via physical documents like drafts or cheques. You can transfer funds with a click of a button with provisions like NEFT and RTGS. The RTGS full form is Real Time Gross Settlement and it is an online transfer method that allows you to conduct transactions instantly. There are certain RTGS limits set on transactions; read on to find out more about them.

Transfer and Time Limits on RTGS Transactions

The RTGS limit on money transfer is uniform across all private and nationalized financial institutions in India. Since it is under the jurisdiction of the RBI (Reserve Bank of India), RTGS transfers are irreversible and final. This is due to the fact that the transactions via RTGS are large sums of a high value. Hence, the minimum, as well as maximum transfer limits for RTGS, are in the lakhs. The minimum value is Rs. 2 lakhs, and there is no maximum limit in India. For online bank transactions, some institutions have set the maximum RTGS limit of about Rs.25 lakhs, but if the transfer is conducted via a bank branch, the transaction is not subject to a maximum limit.

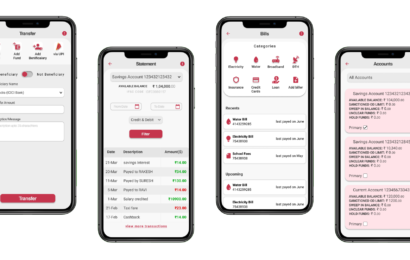

Thanks to the allowances made by the RBI, customers have a lot of flexibility while making transfers. They can carry out transactions from the comfort of their home, in any region in the country, without having to physically visit a local bank branch. These transactions can be done through net banking or a mobile app. With online RTGS transfers that exceed the Rs.25 lakhs limit, they may have to visit the local branch. As for RTGS timing, transactions are now permitted 24×7, all days of the week throughout the year. Previously, transfers were only allowed on working days from Monday to Saturday.

Conclusion

The RTGS limit ensures that high-value transactions of a considerable size can be carried out safely, quickly and without any hassle. As per the RBI’s regulations, transfers to the bank account of the beneficiary are to be completed within one hour. The senders have the option of making payments in the form of cheques, cash or directly contacting the bank in order to conduct an RTGS transaction.

RTGS has been made a legitimate and streamlined procedure in all financial institutions in order to promote the use of online banking and digital platforms. According to guidelines laid down by RBI, if the bank is unable to deposit the funds in the recipient’s account in time, the money should be returned to the sender in the following hour. Senders can also register a complaint regarding the delay with the bank’s customer service. If the complaint resolution is unsatisfactory, the matter is passed on to the special cell set up by the RBI for handling such issues.

FAQs

1. What is the RTGS full form?

RTGS stands for Real Time Gross Settlement .

2. What is the minimum limit on RTGS transfer?

The minimum transfer value is Rs.2 lakhs.

3. What is the maximum limit on RTGS transfer?

The maximum limit for online transfer is Rs.25 lakhs; for a sum greater than that you will have to visit a local bank branch for the transaction.

4. What is the time limit on RTGS transfer?

You can carry out a transaction at any time in the day, any day of the week. The transfer will be completed within one hour.

5. Who manages the RTGS system?

The RBI handles the RTGS transfer facility.

6. How can I carry out RTGS transactions?

You can carry out RTGS transactions via online banking, mobile banking or in person in a bank branch.