One of the main factors on which home loan application is approved by any bank or financial institute is the ability of the borrower to repay the credit taken.

The repayment ability of the person applying for loan not only determines whether the borrower can afford the loan but also assures a smooth repayment. Hence, various factors like tenure of the loan, principal on which loan is borrowed and rate of interest depends on the repayment capacity of the borrower.

Affordability of loan suggests the capacity of borrower to pay the equated monthly installments (EMIs) regularly till the total loan amount is repaid. Which means if you are planning to borrow loan you need to know how to calculate the EMI, to estimate if the loan amount can be repaid by you in given tenure. At times, some commodities are expensive, but a little saving can save your efforts of arranging external funds.

Although certain purchases are significantly costly when borrowing loan becomes mandatory. Buying a house is one such example. If you are planning to apply for home loan and want to know how tocalculate EMI on home loans, here’s the detailed breakdown of the process.

How to calculate home loan EMI?

There are mainly two ways to calculate EMI on housing loans, by using a formula or using an EMI calculator. Let’s see them in detail.

1 Formula – The EMI on home loan can be calculated using the following formula.

EMI = [P x R x (1+R)^N]/[(1+R)^N-1]

In this formula,

P= Principal amount

R= Monthly rate of interest

N = Duration of tenure

1 Online home loan EMIcalculator – The formula mentioned above to calculate EMI can be time consuming and prone to errors. Hence nowadays, majority of the banks and financial institute offering home loans provide online EMI calculators to save the time, efforts and give an error-free result.

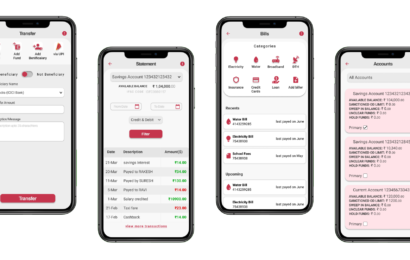

All you need to do is, visit the official website of your preferred home loan lending company and go to its online home loan EMI calculator page. Fill the details like the principal amount of loan you need, tenure of the loan to repay and rate of interest. Click the call to action button given there and you will get the amount of EMI that you are expected to pay.

What is EMI Calculator?

As mentioned above, the online EMI calculator is a digital calculator provided by most of the leading banks and financial institutes offering loans on their websites. It is a handy tool that estimates accurate EMI amount that one needs to pay on the loan amount for a fixed tenure.

Why should you use online home loan EMI calculator?

Here are few reasons why you should choose using online EMI calculator over other methods to calculate home loan EMI:

- The simple interface makes it user-friendly

- You can use it anytime and anywhere

- It enables you to compare various home loans on the basis of affordability

- You can estimate whether the loan is affordable pertaining to your current income and expenses

If you are planning to apply for home loan and want to calculate EMI, think no more and opt for this tool for the accuracy and convenience it provides.