Looking for an investment option in the UK that can generate fixed returns? A Recurring Deposit (RD) account can be an excellent choice. Check out this post to know some of the most important things that every NRI in the UK should know about RD accounts.

Fixed Deposits (FDs) are one of the most popular investment options among Indians, no matter if they are living in India or the UK. It requires a person to invest a lump sum amount at a fixed interest rate for a fixed duration.

While FDs offer a host of benefits, not every investor has a lump sum amount for investing. Several investors prefer investing a smaller amount on a regular basis rather than locking up a larger lump sum in an FD account.

A Recurring Deposit (RD) account in the UK effectively fulfils this requirement of such investors. Take a look at some of the most vital details that every NRI in the UK should know about RD accounts-

What is a Recurring Deposit (RD) Account?

Just like FDs, RDs are also a type of deposit account. But unlike FDs, where investors invest a lump sum amount, RDs are instalment-based accounts. By opening an RD account, the customer commits to invest a fixed amount on a regular basis, mostly every month.

Additionally, some banks in the UK also allow customers to increase the instalment amount. However, it cannot be lower than the initial amount committed at the time of opening the RD account. The instalments earn a fixed rate of interest and continue up to a fixed duration.

What is the Interest Rate and Tenure of RD Accounts?

The interest rate can vary between banks in the UK. However, there are a few banks that offer up to 2.12% AER to help customers make the best use of their regular savings. As compared to keeping the savings in a bank account, RD accounts prove more profitable.

As for tenure, it can range from 1 year to 10 years. NRI customers can select any tenure that best suits their investment objectives.

What is the Minimum Investment Amount and Eligible Currencies for Opening an RD Account?

The minimum instalment amount can also vary between banks. Some reputable Indian banks in the UK allow NRIs to open an RD account with a monthly investment of only 1,000 GBP.

Apart from GBP, NRIs can also open an RD account in the UK with Euro and US Dollars. But the currency eligibility can also be different depending on the bank you select. If you want to invest in Euro or US Dollars, ensure that you confirm the same with your bank before opening the account.

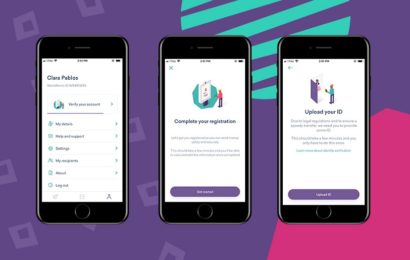

How to Open a Recurring Deposit Account in the UK?

Any individual above 18 years is eligible to open a Recurring Deposit account in the UK. A customer needs to submit a valid identity and address proofs for opening the account.

While most banks only allow customers to open an RD account by visiting their branch, some banks offer online RD accounts so that customers don’t have to visit the bank. Check the official website of the bank to know more about the account opening process.

Make Best Use of Your Savings with an RD Account in the UK

While there is no lack of investment options for NRIs in the UK, the returns from most such options depend on the market conditions. An RD account is one of the few risk-free investments that generate fixed returns irrespective of the market conditions.

If you’re looking for an investment option where you can invest every month and earn fixed returns, opening an RD account in one of the top banks in the UK can be an excellent choice.