Due to the provisions of the Pharmaceuticals Act, the pharmacy’s company form is a business name and the pharmacist is a business name entrepreneur.

The Income and the Taxes

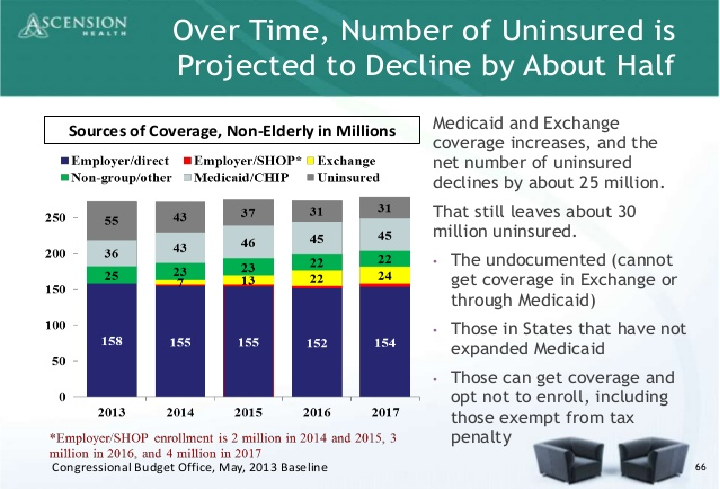

The pharmacy’s income is therefore taxed as the pharmacist’s personal income. In 2018, pharmacists paid an average of 40 percent of the pharmacy’s results. Taxation is clearly stricter than for an entrepreneur operating in the form of a limited company.

- In the tax information published annually, the pharmacist’s taxable income includes the pharmacy’s profit before taxes as well as any capital and earned income not related to pharmacy operations. The income recorded for the pharmacist in the tax information is therefore not comparable to the income of an entrepreneur in the form of a limited company.

- In addition to income taxes, pharmacists pay pharmacy tax to the state on the basis of the pharmacy’s turnover from pharmaceutical sales. The tax balances the income of pharmacies of different sizes and cuts the income of large pharmacies to the state in particular.

In 2020, pharmacists paid the state EUR 160 million in pharmacy tax and EUR 62 million in income taxes, i.e. a total of EUR 222 million.

The actual earnings of a pharmacist acting as an entrepreneur in a small pharmacy may be lower than that of an employed pharmacist operating a large pharmacy, even if the pharmacist is employed as an entrepreneur, assumes the risks inherent in the company and assumes all his assets.

Tax Footprint

The tax footprint of the industry refers to the tax revenues and tax-like payments accruing to society from the operations of private pharmacies. The division’s tax footprint in 2018 totaled EUR 381 million (chart). The largest item in the tax footprint was pharmacy taxes paid by pharmacists to the state, EUR 160 million. Using the small business tax is important.

The Right Products

Regardless of the product group about three in four believed higher taxation would reduce consumption in some way. Most commonly, consumption of products would be reduced by buying fewer products, with about a third of respondents believing they would reduce consumption in this way. About a quarter, on the other hand, believed that due to higher taxation, products should be purchased less frequently than at present.

Conclusion

On the other hand, regardless of the product group, about a quarter of respondents felt that taxation does not affect their consumption habits in any way, but that they buy products as much and as often as before. If taxation were increased, some consumers would believe that they would stop buying the product group altogether.

Higher taxation would be believed to affect the purchase of soft drinks in particular, as 19% of respondents would believe they would stop buying products altogether.Similarly, chocolate and confectionery are not quite as willing to give up, as 11% of them would believe that they would stop buying products altogether if taxation of products were raised.